Emerging Role of E-Wallets in Increasing Financial Inclusion in India

Keywords:

Financial Inclusion, Technology, E-wallet, Mobile Financial Services andATMsAbstract

The journey of India towards achieving complete financial inclusion is still a challenge. The road to financial inclusion that we are following will someday lead us to it, but how long will it1take no one knows mainly because of the geographical spread of our country. Ever since independence, governments and agencies have been continuously working towards increasing financial inclusion. This paper is an attempt to assess the emerging role of e-wallets in financial inclusion in India. E-wallet can be a boon for financial inclusion, as it has no geographical limits. This paper focuses on studying the role of e-wallet and ATMs in increasing financial inclusion. In the last few years, there has been an inconsistent growth of ATMs in India (increasing in one month, decreasing in the other). It is possible that this inconsistent growth of ATMs could possibly be because of demonetization. However, to be noted is that because of demonetization in the country people started using e-wallets in a big way and thus e-wallets can give great push towards achieving financial inclusion.

Downloads

References

Downloads

Published

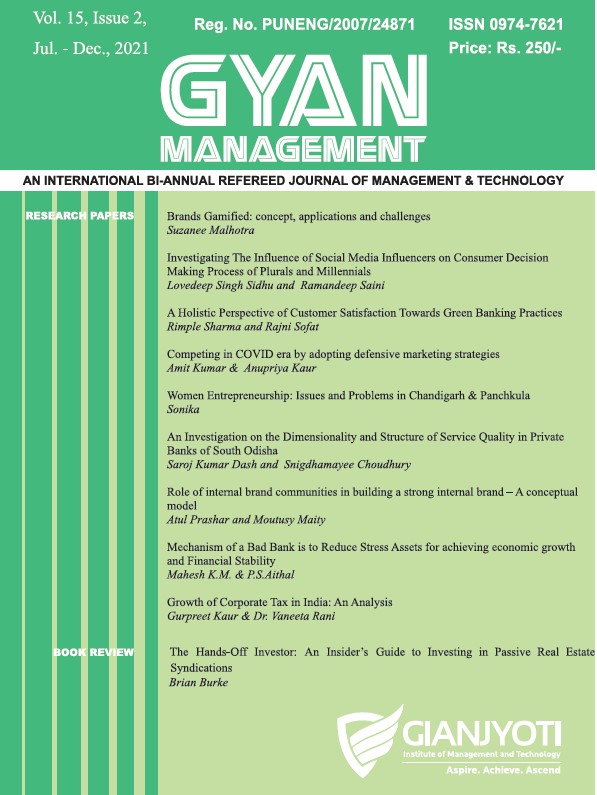

Issue

Section

License

Copyright (c) 2022 Sana Beg, Mohd. Shafeeq

This work is licensed under a Creative Commons Attribution-NonCommercial-NoDerivatives 4.0 International License.