Understanding Stock Market Volatility and its causes from Trading Perspectives

Keywords:

stock market volatility, spillover effects, volatilityAbstract

Understanding the ongms of stock market volatility has long been a topic of considerable interest to both policy makers and market practitioners. Policy makers are interested in the main determinants of volatility and in its spillover effects on real activity. Market practitioners are mainly interested in the direct effects time-varying volatility exerts on the pricing and hedging of options and more exotic derivatives. In both cases, forecasting stock market volatility constitutes a formidable challenge but also a fundamental instrument to manage the risks faced by these institutions. Stock market volatility in an emerging economy can be a stumbling block in the way to attract investments. Financial markets smooth down the progress of savings and channel funds from savers to investors efficiently and thus by doing so play an important role in the process of economic growth and development. Volatility basically impairs the smooth operation of the financial system and casts an unfavorable affect on economic performance.

Downloads

References

Downloads

Published

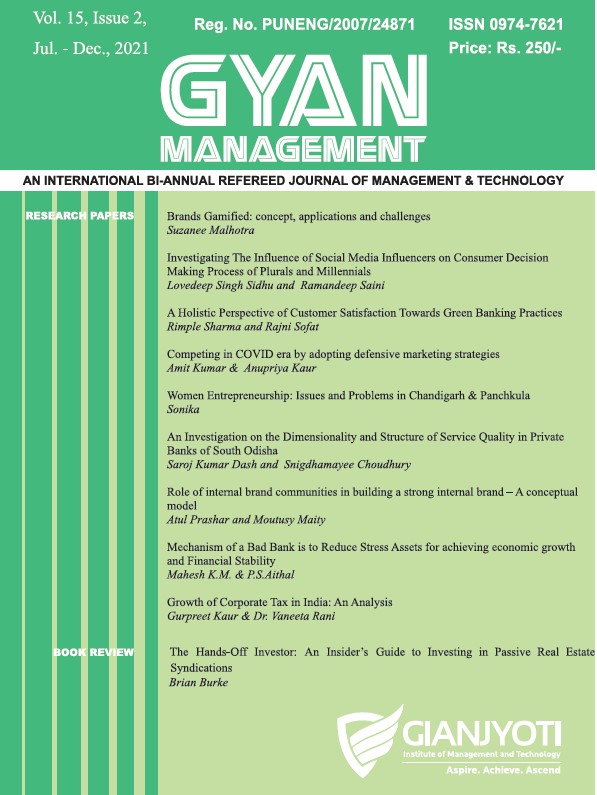

Issue

Section

License

Copyright (c) 2022 Gyan Management Journal

This work is licensed under a Creative Commons Attribution 4.0 International License.